IAG outlines issues

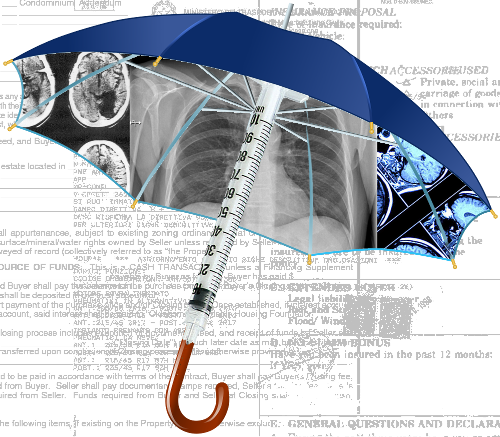

Sydney-based insurance giant IAG says insurance margins have been smashed by wild weather and silicosis claims.

Sydney-based insurance giant IAG says insurance margins have been smashed by wild weather and silicosis claims.

IAG, whose brands include NRMA and CGU, says margins have been hit harder than anticipated in the past year, but it expects margins will bounce back this year.

The company is expected to push harder on price rises for its products, even after the spike in premiums across the industry for the past couple of years.

The insurance giant will also boost profits by writing back almost $200 million that had been tucked away for business interruption insurance claims related to COVID-19. IAG has told investors that the release will be calculated in any dividend return.

IAG’s margins have been hit by the impact of massive east coast floods in March, with claims from wild weather costing $1.119 billion - over $350 million more than originally budgeted for.

IAG has also had to boost the pile of money it has tucked away for claims that can take years to emerge, such as worker’s compensation.

“A strengthening in the commercial liability portfolio of $168 million in the second half of [fiscal 2022] recognises an increase in late reported medium to large claims, notably worker injury claims in the 2017 and 2018 accident years,” IAG said this week.

“In addition, we are projecting higher levels of claim inflation based on recent settlements that reflect a more litigious environment and expanded nature of claims covering mental health and enhanced expectations of the standard of care costs.”

The company is examining pricing and underwriting decisions to “mitigate future impacts for a range of issues including silicosis and worker injury”.

Print

Print