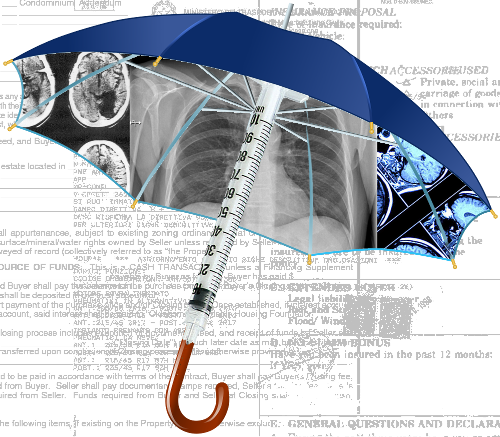

Butler signs insurance rise

Health Minister Mark Butler has officially sanctioned a 3.03 per cent increase in private health insurance premiums, effective from April 1.

Health Minister Mark Butler has officially sanctioned a 3.03 per cent increase in private health insurance premiums, effective from April 1.

The decision comes after an initial request for up to a 6 per cent hike by insurers was declined in December, citing public interest and the current economic climate marked by cost-of-living pressures.

Mr Butler says affordability is key for the 15 million Australians with private health insurance, and that he “wasn't prepared to just tick and flick the claims of health insurers”.

He highlighted the industry's need to provide a more reasonable offer in the face of “record profits” and the global cost of living crunch.

The government says the approved increase is part of a commitment to ensure that health insurance premiums remain below the annual rise in wages, pensions, and inflation.

But the increase has raised concerns about the sustainability of the private hospital system.

With rising operational costs and a trend towards day surgery over longer stays, the industry faces financial pressures.

Sixteen private hospitals have announced closures or revocations of their private hospital declarations since 2023.

“If one part of the system fails, we all fail,” says NIB CEO Mark Fitzgibbon.

The Australian Private Hospital Association has warned of further closures unless private insurers contribute more to hospital sustainability.

Michael Roff, CEO of the association, has called for health insurance companies to prioritise the private health sector's sustainability over profits, highlighting a disconnect between hospital cost increases and the benefits paid by health insurance companies.

Individual insurers have been granted varying premium increases, with CBHS Corporate Health and NIB receiving approval for the highest hikes of 5.82 percent and 4.10 percent, respectively.

The major insurers, Bupa and Medibank, will also see above-average increases. Insurers have pledged to inform customers of the changes and encourage policy reviews to ensure continued value.

The government says the premium rise is part of broader efforts to deliver value for money from private health insurance, including the provision of $7.3 billion in rebates to policyholders and initiatives to reduce healthcare costs, medical device pricing reforms and enhanced transparency for out-of-pocket expenses.

The full list of approved premium increases is accessible on the Department of Health's website.

Print

Print